Amazon was once again the dominant retailer this Black Friday and Cyber Monday. The company reported recording breaking sales figures during the holiday shopping period it calls “the Turkey 5,” an internal codename for the five days stretching from Thanksgiving to Cyber Monday. During this time, Amazon advertising and low priced shopping deals become red hot opportunities for sellers and shoppers alike.

While Amazon has delivered millions of orders during the holiday period, Teikametrics’ machine learning technology has been crunching billions of data points to help thousands of our sellers optimize for profitability to meet the surge in demand. Our Retail Optimization Platform optimizes Amazon advertising for over 2% of all sales on the marketplace. This represents a significant percentage of Amazon.com’s entire Gross Merchandise Volume (GMV).

Although Teikametrics has big data that represents a significant portion of Amazon’s total supply chain, our econometrics and data science team also works to understand consumer dynamics. Understanding this classical economic model, where supply is optimized to meet demand and maximize profitability, is vital to our mission.

We commissioned an ‘exit’ survey of 500 Amazon shoppers to understand consumer demand following November 30th – December 3. Respondents were weighted by age, region, and gender for an accurate representation of the U.S. population.

Over 70% of shoppers were Amazon Prime members. Respondents also self-identified into a subset of shoppers who shop on Amazon. They were weekly (25%), monthly (32%) or a few times a year (43%). Here are some of our findings:

Amazon Advertising Holiday Shopping Index

Amazon Ads Are Blending in for Returning Shoppers

During the Turkey 5, record setting sales were also met with record setting spend on Amazon advertising. The recent spike added on to the 250% increase in brands advertising spend since 2017.

The advertising spend is certainly showing up in search results on the Amazon marketplace. Even unscientific research shows that common searches are turning up sponsored product search ads that dominate the first half of search results.

But are Amazon shoppers noticing the ads? Given Amazon is a store first, the Amazon advertising experience is a lot more seamless than other platforms. This is especially true for younger shoppers.

That may be the reason most Amazon shoppers aren’t even noticing the advertisements (39%). Following those that aren’t seeing any advertisements, 33% reported seeing the same amount and 20% are seeing more. Only 9% of Amazon shoppers believe they are seeing fewer advertisements this holiday season. Amazon Ads Are Actually Helpful on the Path to Purchase

Amazon Ads Are Actually Helpful on the Path to Purchase

Amazon shoppers that saw more advertisements were most likely to report ease in finding desired gifts.

This is likely another sign of ad parameters on Amazon enabling brands to provide more targeted sponsored products.

Subsequently, targeted ads may actually be helping shoppers. Targeted ads may actually be helping shoppers find desired products among hundreds of millions of products on Amazon.

With Search Ads, Amazon Follows Google’s Less Intrusive Ad Delivery

According to eMarketer, Amazon controls 4% of an anticipated $100B worth of digital advertising spend in 2018 in the U.S. This makes Amazon the third largest digital advertising platform in the country behind #1 Google (37%) and #2 Facebook (21%).

Amazon advertising is still in its early days in claiming its spot as the largest digital ad platform. Now when asking Amazon shoppers which digital platform they see the most advertisements on, we expect a similar list.

However, nearly twice as many Amazon shoppers in our poll saw more advertisements on Facebook (55%) than Google (27%). Amazon fell firmly at #3 with (12%). That may seem puzzling, given Google is bringing in nearly double the advertising spend of Facebook.

What it likely comes down to is the method for delivering those ads — search. Google’s lead in advertising is largely driven by its core search ad business. This is responsible for around 75% of its U.S. ad revenue. Despite being nearly 20 years old, search is still very lucrative. Specifically, consumers searching for any and every fact through Google on their mobile devices has given search ad budgets a renaissance in recent years. Search continues to provide less intrusive means for ad delivery and product promotions.

At the very least, Amazon shoppers won’t have to worry about advertisements ruining the cool factor as Facebook did. As Amazon becomes the “Digital Mall of America,” shoppers are becoming more familiar with seeing products not directly related to their search intent. Specifically, shoppers are anticipating seeing products not directly related to what they are searching for.

On a platform like Facebook, product ads can feel intrusive to the experience because users intend to connect socially. On the other hand, ads on Amazon naturally blend into the integrated marketplace experience.

The Holiday Shopping Experience on Amazon

It’s Getting Easier, Not Harder, to Find Holiday Gifts on Amazon

Amazon is responsible for around 50% of all online sales in America today. As a result, shoppers can buy almost everything they can imagine. However, has it gotten easier to shop on Amazon this holiday season versus last holiday season?

Yes, says over 31% of Amazon shoppers we polled. That’s a pretty good uptick in only a year’s time. Amazon Prime members were even more likely to say it has gotten easier to find gifts on Amazon (40%).

However, the majority of shoppers (64%) noted they haven’t seen any noticeable difference. The big news is that only 5% said finding gifts on Amazon has gotten harder. Amazon shoppers are still finding what they want. This is happening despite fears that Amazon has gotten too noisy between advertisements (more on that in a bit) and countless SKUs.

Is Amazon an Island of Misfit Toys?

Amazon has taken big steps to become a leader in the post-Toys”R”Us, toy-buying landscape. Specifically, the company shipped its inaugural printed holiday toy catalog in November to millions of customers to raise awareness and remind buyers familiar with catalog shopping of their product offering. Meanwhile, Amazon’s 12 Days of Deals kicked off on December 4 with big sales on toys.

However, 86% of the Amazon shoppers we polled said they’d be buying the same amount or fewer toys on Amazon this holiday season compared to last holiday season. Meaning, only 14% of Amazon shoppers actually said they’d be buying more toys on Amazon this holiday season. This could be for a number of reasons, including low stock of the most popular toys on Amazon, such as the baby shark singing toy that sold out in three days. We did find that 18- to 34-year-olds (21%) were most likely to say they were buying more gifts on Amazon this holiday season. This demographic grew up with shopping online most of their lives. They are also more familiar with not heading to the nearest Toys”R”Us for their holiday gifts. Therefore, they may be the most compelled to recognize Amazon as the new #1 in holiday toys.

We did find that 18- to 34-year-olds (21%) were most likely to say they were buying more gifts on Amazon this holiday season. This demographic grew up with shopping online most of their lives. They are also more familiar with not heading to the nearest Toys”R”Us for their holiday gifts. Therefore, they may be the most compelled to recognize Amazon as the new #1 in holiday toys.

Those at the lower end of this age bracket that may still be buying toys like video games for themselves. In addition, older millennials are starting to buy gifts for their own kids and family. As a result, we’ll likely see an emerging generation of gift recipients become most familiar with holiday toy gifts from Amazon.

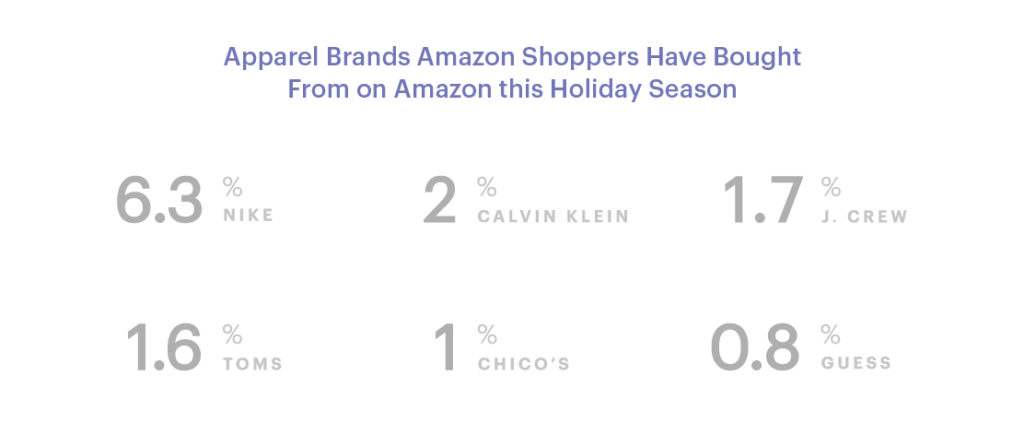

Nike Takes Holiday Lead of Apparel Brands Selling on Amazon

With several major retailers recently deciding to join Amazon instead of competing with them, we also were interested in a consumer pulse of apparel brands shoppers are buying on Amazon brand storefronts this holiday season. This trend makes send, with retailers understanding that they need to be wherever the consumer is shopping, and Amazon now taking the online lead from Google in product searches.

While it’s still early in Amazon becoming a destination for buying fashion brands, we asked Amazon shoppers which major retailers they’ve purchased from on the Amazon marketplace already this holiday shopping season.

While only a small percentage of Amazon shoppers said they had bought directly from a major apparel brand selling on Amazon, it appears Nike has the early lead in coveting Amazon shoppers. Specifically, over 6% of shoppers said they have already purchased a Nike product on Amazon this holiday season. This number nearly doubled to 11%, when we looked at 18 to 34-year-old Amazon shoppers.

Backtracking the overall list among all Amazon shoppers, Calvin Klein (2%) and J Crew (1.7%) rounded out the top three. However, among women Amazon shoppers, Toms shot to #2, with 2.3% of women saying they bought Toms shoes on Amazon already this holiday season. Perhaps, Toms’ campaign to end gun violence in America has driven some goodwill and awareness with Amazon shoppers this holiday season.

Free Shipping with No Minimum Purchase is Paying Off for Amazon

Amazon is offering free shipping without a minimum purchase amount for the first time this holiday season and it appears to be a draw that a majority of Amazon shoppers can’t resist.

Shoppers reported free shipping (24%) enticed them the most to buy a product on Amazon this holiday shopping season. That answer ranked just above a product being on sale (23.7%). It also ranked above a product being delivered within 2 days (21%), and a product having 4 out of 5-star reviews (16%).

However, millennials and Gen X’rs were more enticed by the immediacy of buying holiday gifts on Amazon. A product being delivered in two days was the top enticement for buying holiday gifts on Amazon according to millennials (30%) and Gen X’rs (33%), while only 13% of those 45+ said that two-day shipping enticed them the most to buy a holiday gift on Amazon.

These two demographics also had the highest likelihood of being Amazon Prime members among the Amazon shoppers we polled (76%). Therefore, they likely see fast shipping as important as free shipping.

Amazon is the Only Online Store Shoppers Use for Last Minute Holiday Gifts

Last minute shoppers chose between Amazon and physical retailers when it came to gift buying after Cyber Monday. Buying last-minute gifts from an online retailer not named Amazon in the weeks leading up to Christmas is not an option.

Amazon shoppers preferred visiting a physical retail store (56%) for grabbing a last minute holiday gift. However, they were not willing to bet on ordering from an online retailer not named Amazon (5%). Meanwhile, 40% said that they’re most likely to be getting last minute holiday gifts from Amazon.

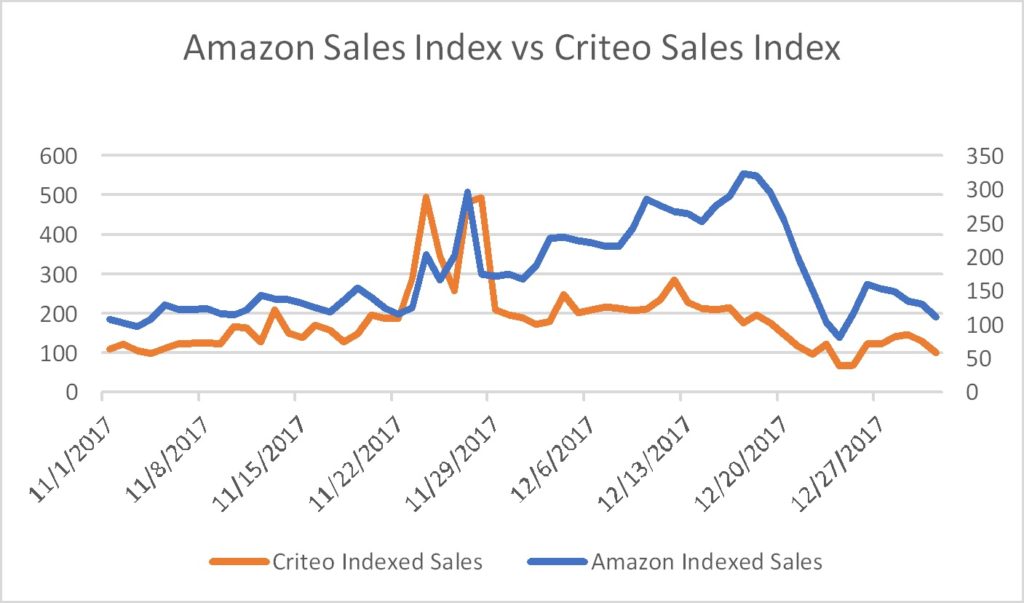

These survey findings are in-line with research Teikametrics recently conducted on historical holiday shopping trends on Amazon versus other big online retail sites such as Walmart, Target, Macy’s, and Best Buy.

Based on 2017 shopping data, the latter grouping appears to be more micro-seasonal with sales than Amazon. They see a sharper spike in transactions at the beginning of the Turkey 5 and a more drastic decline in sales at its conclusion.

Comparatively, Amazon historically sees sales levels briefly level off after the post-Thanksgiving rush. Sales then begin to grow again throughout December before peaking again a few days before Christmas. Based on our survey findings, we’ll likely see this again in 2019.