When it comes to making the most out of your Amazon advertising, different sellers are constantly iterating on exactly what they can do in order to maximize their profits and grow their business. One of the strongest platforms in this regard is Amazon, but executing a strong advertising strategy on Amazon is quite different than doing it on Google—or any other digital advertising platform, for that matter.

This guide is designed for sellers having some success with Amazon advertising, but are looking to take things to the next level. We’ve pulled exclusive data about advertising spend relative to sales performance on the platform and are ready to put it to use to help you and your business.

How Amazon has become an Advertising Platform

Before getting into the nuts and bolts of what makes Amazon advertising effective, we should provide a brief overview on what makes the platform different and how it managed to become so prominent so quickly in the digital space. After all, despite being a relative newcomer, last fall Amazon officially slid into the 3rd place spot for all digital advertisers behind only Facebook and Google. This accounts for 4.1% of all online ads.

Equally important is the fact that experts believe that this is only set to trend upwards. Amazon is poised to become a $38 billion ad business by 2023. This is especially notable considering the fact that Amazon’s main purpose is still e-commerce first, advertising second. This shows the value of the platform for potential advertising.

With that said, what are your basic options for Amazon advertising? Cowen and Co. did a survey asking ad buyers the breakdown of their spending. Here’s what they found:

Sponsored Products

A total of 29% of buyers used these, which appear alongside, above, and below the search results. They can also appear on product detail pages. These are the most popular option, mainly because it’s possible to buy space on certain searches for certain keywords or products. The best comparison to make for these is Google’s product listing ads. Depending on the bid that you put in, your ad may either appear above or below the search results of customers who end up searching for the related keywords that you bid on.

Being the most popular Amazon ad, it’s fitting that a lot of the innovation we see on the platform revolves around these ads. Originally, the major difference was the fact that sellers could choose automatic or manual targeting to match with certain search terms and keywords. This is only the beginning, though. Amazon recently implemented new bidding features, offering both manual and automated ways to adjust bids as needed.

Sponsored Brands

These ads, formerly known as headline search ads, were purchased by 18% of companies in the Cowen & Co. survey. These appear above Amazon search results and make it possible for advertisers to promote multiple products and gain brand awareness.

Many companies try to use these at the top of their sales funnel due to their general prominence, pairing them with general category keywords or branded searches. The primary function of these ads is to increase brand recognition across the platform. Putting together Sponsored Brands ads lets you implement a custom headline, your logo, and ASINs. One notable feature that not everyone is taking advantage of is the fact that you can send clicks you get from these ads to two primary destinations. These include:

- Storefront page

- Products Listing Page

The two above options are where the majority of Amazon advertisers should focus their efforts. However, there are other methods available, and we will cover these briefly.

Video Ads

A total of 21% of buyers invested in these ads, which not only can appear on Amazon but can also appear on Amazon-owned sites like IMDB. Video ads are growing in popularity in the digital space, but on Amazon, you are probably better off with Sponsored Brands or Sponsored Products.

Product Display Ads

A total of 19% of buyers opted for this option. Here, ads appear along or below search results or on product detail/customer review pages. The ads can appear in Amazon-generated marketing emails as well.

Traditional Display Ads

People who pay for advertising on other sites are probably familiar with this option. These can show up as banners on Amazon as well as Amazon devices like the Fire Stick and Kindle.

Due to the potential price involved, some companies may feel a bit spooked when it comes to investing in their advertising options, despite the large potential volume. In addition, some people who are only making a small investment may be afraid to progress further.

Our Statistics On Amazon Advertising

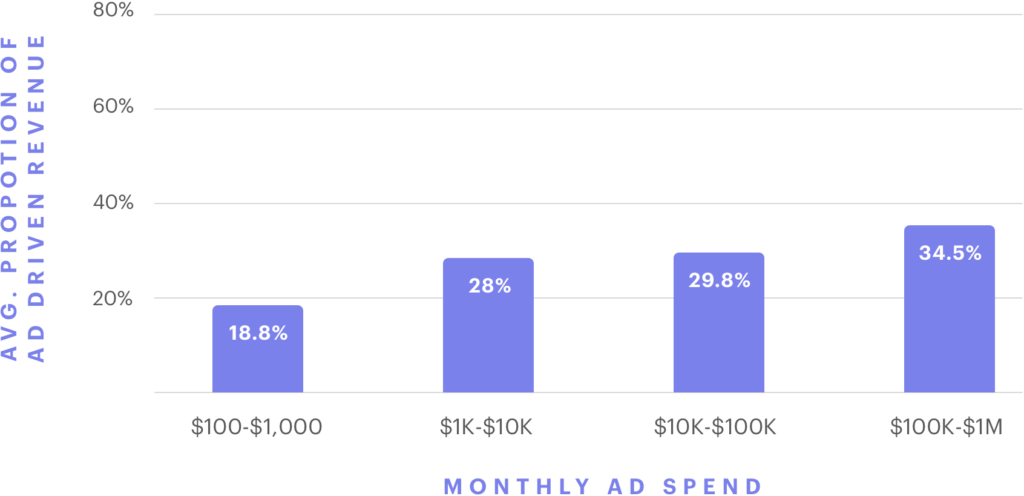

As a note, the data we are going to talk about in this section comes from pooling Teikametrics sellers ad spend on Sponsored Products relative to total ad-driven revenue. This includes a diverse set of sellers across several different varying growth stages and categories. We’ve organized our findings across different tiers of ad spending, and we found the following average proportions for ad-driven revenue:

1. Amazon advertising drives increased sales for everyone.

Marketing budget constraints are often a major concern for e-commerce brands. Without a physical location, many of these companies need to step up their digital advertising strategies to compete, but when it comes to a platform as large as Amazon there’s a natural reticence about smaller companies thinking their investments will be enough. This data shows that that mindset is a mistake.

Even at the smallest band of advertising spending, there is clear evidence that any Amazon ad spending will yield some sort of positive results. This means that companies of any size in any niche can see growth by advertising on Amazon. However, this only occurs with a well-executed strategy, which we will cover later on.

2. Spending more is directly correlated with an increase in ad-driven revenue.

On some platforms or in other advertising scenarios, there’s such a case as a “plateau,” a point where you find that you stop seeing a return on your investment despite putting more money into it. Even some Google and Facebook campaigns aren’t immune to these issues. However, as our data shows, that isn’t the case at all for Amazon. Moving to higher bands of spending is directly correlated with higher amounts of ad-driven revenue.

This is part of why we see so many large advertisers shifting more of their advertising budgets to Amazon advertising. They are already able to enter that $100,000-$1,000,000 range and reap the benefits that come with it and execute effective Flywheel strategies, where ad-driven sales contribute to recurring organic sales growth. This phenomenon only occurs with profitable advertising campaigns, which we will also cover later on.

With these two key points made, what are some of the reasons behind this data?

One major point that may be behind the great ROI that Amazon provides is the fact that its status as an e-commerce titan means that it’s generating a lot of valuable shopping data. This data makes it a lot easier to position appropriate ads in front of the customer, which means greater sales and conversion.

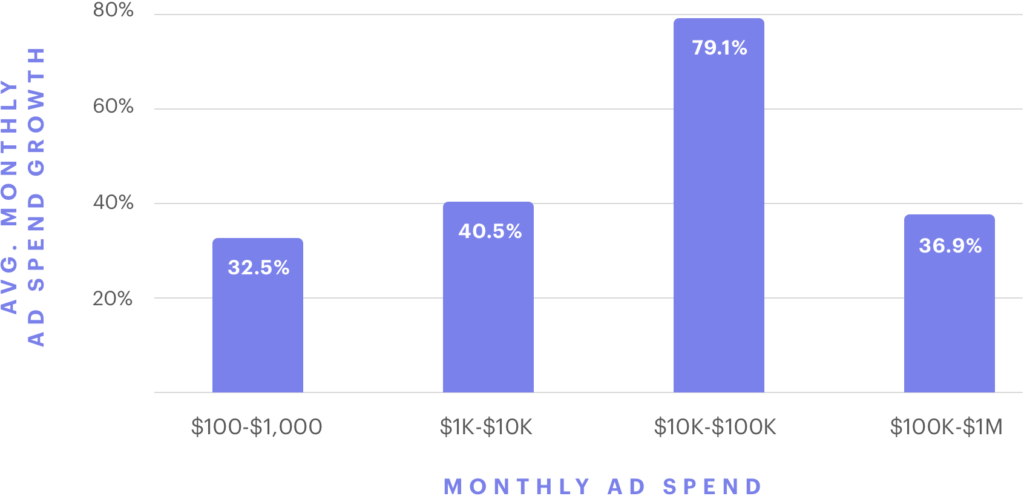

Specifically, Amazon gives its advertisers the ability to target potential customers based on their search histories, not just demographics. Combine these factors with Amazon’s already-impressive market share, and it’s easy to see why Amazon advertising spending is growing at a faster rate compared to its competitors. We also compiled data from our sellers looking at the yearly average monthly ad spend growth across the same tiers of monthly ad spend. This came out as follows:

At first glance, it’s clear that we are seeing major increases in investment at all levels. But let’s pay special attention to the $1,000-$10,000 and $10,000-$100,000 spend brackets.

The fact that it’s the higher spend brackets that are seeing the growth shows that companies are seeing positive results. This doesn’t just mean that they are getting more conversion from the ads, but the steps that Amazon is taking are being well-received. The combination of strong ad performance and a more efficient platform is driving further investment across all segments. This trend goes hand-in-hand with the rising amount of new advertisers who are adopting Amazon advertising.

This suggests that there is a long-term trend of success with this platform, as opposed to treating it like a fad. What happens if we take a closer look at advertising performance in specific categories? Are all segments seeing the same degree of advertising success, are some categories better for advertising than others? Again, we have data to help in this area.

Breaking Down The Statistics By Category

For our category-based data, we compiled a sample set of data from Teikametrics sellers across a set of prominent Amazon product categories.

This ensures that we were getting a concrete look at the overall metrics for each category rather than getting an inaccurate picture based on the top or lower performing advertisers. Category-specific knowledge is more important than ever because Amazon offers category-specific targeting for Sponsored Products, making it more feasible than ever to pair your company’s products with complementary ones.

Let’s focus on three categories and take a close look at exactly how well they performed in some key metrics.

Beauty

Amazon first launched its luxury beauty portal in 2013, and recently, the sales for health and beauty have soared, hitting $1.9 billion in Q2 2018 and increasing 23% each year. With this said, our data separates the health and beauty segments. This is an important distinction because while the markets for products like skincare and supplements may have some overlap, for advertising purposes, they may not be that complimentary. With that said, even taking health out of the equation, Beauty is still performing well in the advertising segment. Here are some of the key metrics of note from our data:

The beauty segment, like the other two segments we cover here, has an average ad spend that is falling in that prime $10,000-$1,000,000 segment. This means that these sectors may be partially behind that enormous 79% monthly ad spend growth over the last year.

Another thing worth talking about when it comes to these numbers is the conversion rate. The average rate you see for ads off Amazon is roughly 1.33%. When you go onto Amazon, the average is 9.78%. The beauty segment manages to eclipse both numbers.

Industrial Supplies

Here are the metrics of note from Industrial Supplies.

Out of the nine total categories that we profiled in our data assessment, Industrial Supplies recorded the most average ad spending at $36,379.71. This isn’t a huge surprise, though. Amazon Business came on the scene when the industrial supply sector was naturally fragmented. This meant that there was a perfect space for a disruptive competitor.

Filling a need that the business customers had is reflected in some of the numbers here, like a massive 47% of sales from advertising as well as an ACoS that is far lower than the beauty sector. However, advertising to B2B customers is very different than B2C ads. Trying to apply one set of tactics to another segment will yield a poor result.

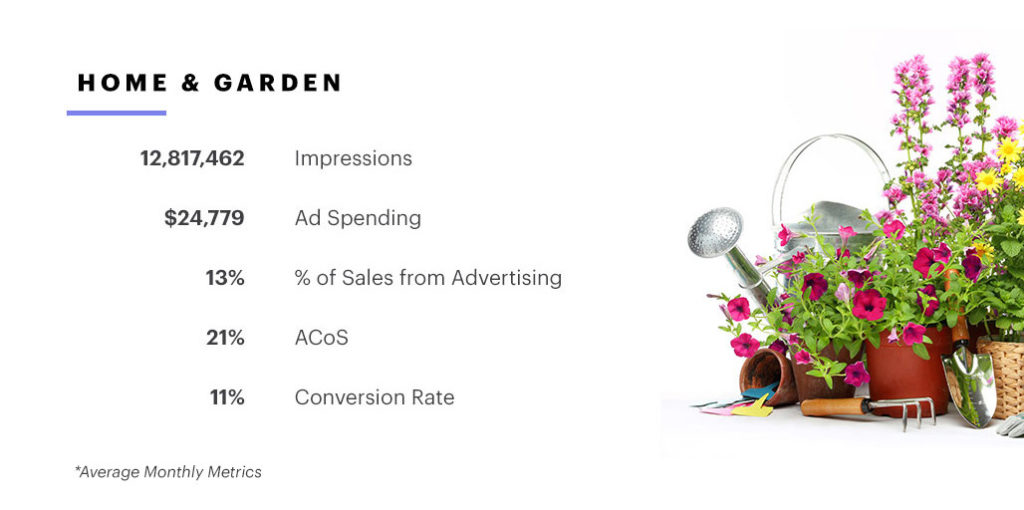

Home And Garden

Here are some of the key statistics of note from Home and Garden.

Home and Garden advertising is unique because compared to the other two segments on this list, the success of advertising is going to have a seasonal twist. Many of the top performing sectors in the summer months will naturally revolve around the outdoors, while in winter, products that help with efficient energy consumption are at a higher premium. Yet, if we look at the statistics here, they aren’t too far off from the other two segments. What this means is that Amazon is clearly effective at putting the right advertisements in front of the right customers at the right time.

How To Properly Utilize Amazon Advertising

Data from all three of these sectors indicates that it’s not just a few hot industries; furthermore, it demonstrates Amazon advertising is effective and yielding explosive results. All types of companies can leverage Amazon advertising and see success, if they create and implement an effective advertising strategy. Here are some pieces of information that you can implement to find success in these areas.

Understand Your Amazon Flywheel Effect

One of the fundamental principles behind Amazon is the flywheel effect, the concept of using advertising to generate earned media to accelerate overall sales growth. Specifically, increased exposure driving additional sales has value beyond increased ad revenue. The business’es momentum grows as more reviews and sales rank is generated from increased ad sales. This potentially earns you an Amazon’s Choice designation. Take a moment, look at your advertising strategy, and see if you can identify a business model that has a profitable foundation to scale before amplifying products with advertising.

Choose Keywords Wisely

Anyone in the SEO world could tell you how choosing the right keyword is the seed from where the entire campaign sprouts. With Amazon advertising, it’s a similar situation, where bidding on the wrong keywords can hurt not only conversion but also increase costs. Sellers often don’t apply a data-driven approach to finding the most effective search terms.

Bidding on keywords often tied closely to the product. There is some logic to this. If you’re trying to advertise birthday candles, you would want to bid on birthday candles as a keyword. However, these general keywords tend to be both expensive and competitive. It’s difficult to maximize advertising performance if you spend your budget on expensive, unproven keywords. At the same time, constantly bidding too low will yield minimal results.

Continuously Optimize

Let’s say that you manage to avoid some of the above issues and effectively manage a well-optimized Amazon advertising campaign. You can still run into problems if you don’t execute changes based on a data-driven optimization strategy. Even a campaign that starts strong needs constant adjustments. This includes adding effective search terms from automatic to manual campaigns as keywords, halting low-performing keywords, and refining top performing keyword match types.

The good news is that there are existing tools out there that can help you with this issue. These are necessary, as automated tools are becoming more popular to deal with the greater amount of data flowing in.

Keep Your Expectations Realistic

Even as there is success all around you, understand that it is going to take time for any advertising initiative to truly take off. However, there’s a temptation to jump the gun if you don’t instantly see an ACoS that’s where you want. In some cases, launching products for long-term success requires a growth stage.

Data suggests that Amazon advertising will be growing well into the future, but what it takes to be a part of that may change. For example, we mentioned there is a growing amount of automation available for Amazon advertising. This is especially the case for search ads, which are perceived as the most effective ads.

How Teikametrics Enhances Your Amazon Advertising

At this point, we’ve established a few major points that are worth revisiting:

- The Amazon Advertising ad platform is red hot and poised for continued growth with increased opportunity for sellers.

- Data suggests that companies can see positive ROI at any level of ad spending.

- However, that only happens if the advertising strategy adheres to the basic rules and standards of advertising. It’s also important to have knowledge of what processes are needed to see the most success on Amazon specifically.

The third point here is the key reason why many people may be struggling with Amazon advertising. Opportunity for growth is out there in all major product categories, but some sellers may be going about this incorrectly. This is why it’s important to stay up to date on all things Amazon and use automation tools. This is where Teikametrics comes in.

Teikametrics Flywheel is a Retail Optimization Platform (ROP) that applies machine learning and data science to help maximize profits from Amazon advertising. We accomplish this with a three-pronged approach: providing context with business metrics, showcasing profitability at a product level, and using the world’s most sophisticated Amazon advertising algorithm to automate keyword bidding and optimize campaigns.

Business Performance Reporting

We mentioned earlier that an effective Amazon advertising campaign should be able to chart its own flywheel effect. Understanding the relationship of how ad sales impact organic growth is essential. However, that doesn’t happen unless you have a way of measuring advertising performance relative to total business performance. Teikametrics Flywheel works around this issue by streamlining complex reporting to simplify business KPIs:

- Gross profit

- Total sales

- Total ad sales

- TACoS (Total Advertising Cost of Sale)

With these metrics, you have a clear understanding of how advertising is impacting your overall business performance. Having real-time business metrics lets companies apply a critical and contextual perspective on how exactly their ad spend is affecting overall sales and profitability. Without putting these concepts together it’s impossible to work towards long-term success. This is why all Amazon advertisers need some means to collect business metrics. That said, Amazon doesn’t exactly make this easy. That is why the Flywheel platform simplifies the calculations, reporting, and results in a seller friendly interface.

Product Level Profitability

Amazon sellers can offer many different products at the same time. They all often work together to generate momentum for the overall business. However, two given products can have wildly different profit margins. This makes understanding gross margin on a per-product basis essential before advertising is applied to minimize risk.

The most informed ad strategy begins by understanding how much money each product sold is generating after accounting for product COGs, Amazon fees, and advertising costs. Teikametrics Flywheel lets sellers see which of their individual products stand to benefit the most from advertising. This is done by reporting metrics like gross profit and gross margin at an SKU level. Not only does this streamline complex calculations, but it also identifies exact opportunities for optimizing ad spend.

World Class Amazon PPC Optimization

Manually updating bids and optimizing campaigns is time intensive and can quickly become unmanageable to perform at optimal efficiency. Teikametrics Flywheel has a built-in bidding algorithm that automatically adjusts keyword bids to earn the best value for clicks. The price aware bidder is the world’s most sophisticated algorithm designed specifically for Amazon advertisers. With it, all keywords bids are made at maximum efficiency using price and sales data. Moreover, it identifies top performing search terms, suggests keyword match types, and eliminates wasted ad spend with negative keyword recommendations.

With this combination, Teikametrics is the perfect partner for you to realize long-term sustainable growth while maximizing profits from Amazon advertising. It puts cutting-edge data science at your disposal so you can get the most out of your precious advertising dollars and efficiently control your bids and keywords across thousands of products. Moreover, its interface gives you an unparalleled view of your company, from the broad to the granular, total revenue to product-level campaign performance. You get both a revolutionary algorithm and complete visibility. This combination is what makes Flywheel unlike anything else on the market.

And did we mention it works? Businesses typically see a 34% increase in revenue within their first 60 days. So set your flywheel in motion—your business will look better and better as it comes full circle.

Try Teikametrics Flywheel for free today and start maximizing profit from Amazon advertising!